|

In the long history of false promises made by trade negotiators, the

claim that China’s entry into the World Trade Organization (WTO) in

2001 would reduce the U.S. trade deficit with China and create good

U.S. jobs stands out. The total U.S. goods trade deficit with China

reached $324.2 billion in 2013. Between 2001 and 2013, this growing

deficit eliminated or displaced 3.2 million U.S. jobs (Kimball and

Scott 2014). As the world’s largest retailer, U.S.-based Wal-Mart is a

key conduit of Chinese imports into the American market. This paper

updates earlier work (Scott 2007) to provide a conservative estimate of

how many jobs have likely been displaced by Chinese imports entering

the country through Wal-Mart:

- Chinese imports entering through Wal-Mart in 2013 likely totaled at

least $49.1 billion and the combined effect of imports from and exports

to China conducted through Wal-Mart likely accounted for 15.3 percent

of the growth of the total U.S. goods trade deficit with China between

2001 and 2013.

- The Wal-Mart-based trade deficit with China alone eliminated or displaced over 400,000 U.S. jobs between 2001 and 2013.

- The manufacturing sector and its workers have been hardest hit by

the growth of Wal-Mart’s imports. Wal-Mart’s increased trade deficit

with China between 2001 and 2013 eliminated 314,500 manufacturing jobs,

75.7 percent of the jobs lost from Wal-Mart’s trade deficit. These job

losses are particularly destructive because jobs in the manufacturing

sector pay higher wages and provide better benefits than most other

industries, especially for workers with less than a college education.

- Wal-Mart has announced plans to create opportunities for American

manufacturing by “investing in American jobs.” To date, very few actual

U.S. jobs have been created by this program, and since 2001, the

growing Wal-Mart trade deficit with China has displaced more than 100

U.S. jobs for every actual or promised job created through this program.

China has achieved its rapidly growing trade surpluses by

manipulating its currency: it invests hundreds of billions of dollars

per year in U.S. Treasury bills, other government securities, and

private foreign assets to bid up the value of the dollar and other

currencies and thereby lower the cost of its exports to the United

States and other countries. China has also repressed the labor rights

of its workers and suppressed their wages, making its products

artificially cheap and further subsidizing its exports. Wal-Mart has

aided China’s abuse of labor rights and its violations of

internationally recognized norms of fair trade by providing a vast and

ever-expanding conduit for the distribution of artificially cheap and

subsidized Chinese exports to the United States.

China trade and U.S. job loss

Exports support jobs in the United States, and imports displace

them. Thus, the net effect of trade flows on employment must be based

on an analysis of the trade balance. This Briefing Paper

calculates the employment effects of growing goods trade deficits by

using an input-output model that estimates the direct and indirect

labor requirements of producing output in a given domestic industry.

The model includes 195 U.S. industries, 77 of which are in the

manufacturing sector.

The model estimates the labor that would be required to produce a

given volume of exports, and the labor that is displaced when a given

volume of imports is substituted for domestic output.

The job losses presented here represent an estimate of what total

employment levels would have been in the absence of growing trade

deficits.

U.S. exports to China in 2001 supported 161,400 jobs, but U.S.

imports displaced production that would have supported 1,127,700 jobs,

as shown in the bottom half of Table 1. Therefore, the

$84.1 billion goods trade deficit in 2001 displaced nearly 1 million

jobs in that year. Net job displacement rose to 4,123,400 in 2013.

Growth in trade deficits with China has reduced demand for goods

produced in every region of the United States and has led to job

displacement in all 50 states and the District of Columbia. The overall

China trade and job loss estimates in this report are based on the

findings reported in Kimball and Scott (2014).

Wal-Mart’s role

Given its enormous size and the fact that it sells manufactured

goods, which have been the primary Chinese export to the U.S. in recent

years, it is natural to try to estimate the role of Wal-Mart as a

conduit for Chinese trade. We find that a conservative estimate is that

Wal-Mart accounted for approximately 11.2 percent of total U.S. goods

imports from China between 2001 and 2013. This estimate is based on

published reports on Wal-Mart trade with China between 2001 and 2004,

including Wal-Mart’s own estimates of its imports from China, on more

recent published data on ocean trade (by company), and on the

relationship between total Wal-Mart sales in the United States and

personal consumption expenditures on goods from the GDP accounts (BEA

2015).

Wal-Mart provided its own estimate for the value of imports from

China in its fiscal year ending January 31, 2004 (Wal-Mart 2007). Most

of these goods were imported in 2003, and the Wal-Mart share of total

imports from China in that year was 11.9 percent. Bianco and Zellner

(2003) and Bianco (2006) have also attempted to construct estimates of

Wal-Mart’s imports from China and have reported imports that yield

shares that are similar to Wal-Mart’s own estimates, with the lowestJournal of Commerce produces annual reports of total U.S. imports and exports of goods via ocean container transport.

While this is a partial and incomplete accounting, it does show that

Wal-Mart was the top U.S. importer of ocean container freight in every

year between 2001 and 2013, and its share of top 100 imports remained

stable in a range from 12.1 percent to 14.8 percent of total imports of

the top 100 importers.

Limited data on total imports by company are also available from

shipments data collected by the U.S. Customs and Border Protection

agency.

Data on Wal-Mart imports are available for only two comparable months

in the study period: November 2007 and 2012. The available information

reports total imports in both kilograms and container equivalents

(twenty-foot equivalent units or TEUs). The Wal-Mart share of total

imports from China increased in both kilograms and TEUs in this period

(Panjiva.com 2015). In short, the 2003 share of imports accounted for

by Wal-Mart as estimated by the company itself (11.2 percent) has

likely only grown since then. However, for this report we make the

conservative assumption that it has remained stable.

But a stable share of Wal-Mart imports implies rapid growth in

volumes. U.S. goods imports from China increased $336.1 billion between

2001 and 2013, as shown in the top half of Table 1, an increase of 329

percent. If Wal-Mart’s share of U.S. imports from China remained stable

in this period at 11.2 percent, this implies that its imports increased

from $11.4 billion in 2001 to $49.1 billion in 2013, an increase of

$37.6 billion. As it is a retailer and not a manufacturer, Wal-Mart

likely exports only a negligible amount to China. Our best estimate is

that Wal-Mart accounts (at most) for roughly 1.0 percent of total U.S.

exports to China. This

in turn implies that Wal-Mart was responsible for a $36.7 billion

increase in the U.S. trade deficit with China between 2001 and 2013.

The Wal-Mart trade deficit displaced 125,800 jobs in 2001 and 541,300 jobs in 2013.

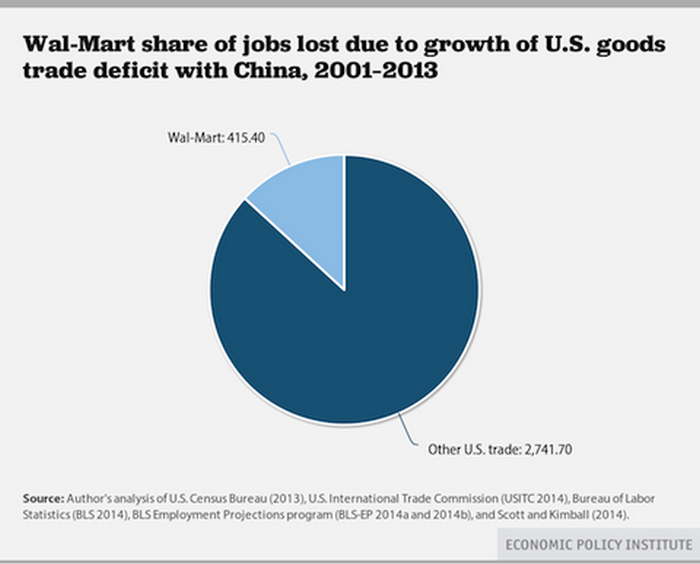

Thus, Wal-Mart was responsible for displacing at least an additional

415,400 U.S. jobs between 2001 and 2013, as shown in the bottom half of

Table 1 and in Figure A. While Wal-Mart was

responsible for 11.2 percent of U.S. imports in this period, it was

responsible for 13.2 percent of the U.S. job losses due to growing

trade deficits with China (Table 1). Since Wal-Mart’s exports to China

were negligible, the rapid growth of its imports had a proportionately

bigger impact on the U.S. trade deficit and job losses than overall

U.S. trade flows with China (since the rest of U.S. trade with China

does include significant U.S. exports to that country). On average,

each of the 4,835 stores Wal-Mart operated in the United States in

fiscal 2014 (Wal-Mart Stores Inc. 2014) was responsible for the loss of

about 86 U.S. jobs due to the growth of Wal-Mart’s trade deficit with

China between 2001 and 2013.

These job loss estimates are conservative because goods sold at

Wal-Mart are primarily durable and nondurable consumer goods, such as

furniture, apparel and textiles, toys, and sporting goods. These are

particularly labor-intensive manufacturing industries and support more

jobs per $1 billion of imports than more capital-intensive goods such

as machine tools, motor vehicles and parts, and aircraft and parts

imported by other U.S. firms.

Job losses in manufacturing account for 75.7 percent of total jobs

displaced due to the growing U.S. trade deficit with China in this

period (Kimball and Scott 2014, Table 3). Jobs in the manufacturing

sector pay higher wages and provide better benefits than most other

industries, especially for workers with less than a college education.

Manufacturing also employs a greater share of such workers than other

sectors (Scott 2013).

The job displacement estimates in this study are conservative. They

include only the jobs directly or indirectly displaced by trade, and

exclude jobs in domestic wholesale and retail trade or advertising;

they also exclude re-spending employment. They

also do not account for the fact that during the Great Recession of

2007–2009, and continuing through 2013, jobs displaced by China trade

reduced wages and spending, which led to further job losses.

Further, the labor-market effects of the U.S. trade deficit with

China are not limited to job loss and displacement and the associated

direct wage losses. Competition with low-wage workers from

less-developed countries such as China has driven down wages for

workers in U.S. manufacturing and reduced the wages and bargaining

power of similar, non-college-educated workers throughout the economy,

as previous EPI research has shown (Bivens 2013). The affected

population includes essentially all workers with less than a four-year

college degree—such workers make up roughly 70 percent of the

workforce, or about 100 million workers (U.S. Census Bureau 2015).

The workers affected by this job displacement include millions whose

jobs were not lost but whose wages were held down because of increased

labor market competition with the job losers. As earlier EPI research

has shown, trade with China between 2001 and 2011 displaced 2.7 million

workers, who suffered a direct loss of $37.0 billion in reduced wages

alone when re-employed in non-traded industries in 2011 (Scott 2013).

In addition, the nation’s 100 million non-college educated workers

suffered a total loss of roughly $180 billion due to increased trade

with low-wage countries. These indirect wage losses were nearly five

times greater than the direct losses suffered by workers displaced by

China trade, and the pool of affected workers was nearly 40 times

larger (100 million non-college-educated workers versus 2.7 million

displaced workers).

Wal-Mart’s U.S. manufacturing promises

In 2013 Wal-Mart announced a plan to purchase “$250 billion in

products that support the creation of American jobs” by 2023 by

increasing purchases of U.S. manufactured goods (Loeb 2013, Wal-Mart

2015a).

To date, very few actual U.S. manufacturing jobs have been created as a

result of this commitment. Wal-Mart remains, by far, the top importer

of ocean shipping containers in the United States with total imports of

more than 775,000 container-equivalents (TEUs) in 2014, exceeding total

imports by Target, the number two importer, by more than 250,000 TEUs

(48.7 percent, more than total Target imports) (Journal of Commerce

2015). In addition, about two-thirds of what Wal-Mart calls

American-made goods are actually groceries, which support few U.S.

manufacturing jobs (Alliance for American Manufacturing 2015).

In 2015, Wal-Mart’s publicly available list of manufacturing jobs

that have been or will be created in the United States includes fewer

than 4,100 specific U.S. manufacturing jobs, and many of those are

promised jobs that firms “will create” up to 10 years in the future

(Wal-Mart 2015c). Since 2001, Wal-Mart’s growing trade deficit with

China has displaced more than 100 U.S. jobs for every job that Wal-Mart

has created in the United States through its “Invest in American Jobs”

program.” Meanwhile, the U.S. goods trade deficit with China increased

by $23.9 billion (7.5 percent) in 2014 (Scott 2015). Continuing growth

in that trade deficit and in Wal-Mart imports will likely displace many

times more manufacturing jobs than Wal-Mart creates in the United

States over the next decade.

Conclusion

The growing goods trade deficit with China displaced 3.2 million

U.S. jobs in the United States between 2001 and 2013, and it has been a

prime contributor to the crisis in manufacturing employment over the

past 15 years. Due to its own growing trade deficit with China,

Wal-Mart alone was responsible for the loss of more than 400,000 U.S.

jobs, 13.2 percent of total U.S. jobs lost in this period. The current

unbalanced U.S.-China trade relationship is bad for both countries, and

Wal-Mart has played a major role in creating that imbalance. The United

States is piling up foreign debt, losing export capacity, and facing a

more fragile macroeconomic environment.

Meanwhile, China has become dependent on the U.S. consumer market

for employment generation, has suppressed the purchasing power of its

own middle class with a weak currency, and, most importantly, has

purchased trillions of dollars of hard-currency reserves in

low-yielding, government securities and other financial assets, instead

of investing these funds in public goods that could benefit Chinese

consumers and workers. In order to artificially and illegally hold down

the value of its currency, and thereby lower the cost of its exports to

the United States and other countries, China has purchased nearly $5

trillion in U.S. Treasury bills and other government securities and

private assets (IMF 2015, SWFI 2015) since it entered the WTO in 2001.

It has also repressed the labor rights and wages of its workers, making

its exports artificially cheap, further subsidizing its exports.

Wal-Mart has aided China’s abuse of labor rights and its violations of

internationally recognized norms of fair trade behavior by providing a

vast and growing conduit for the distribution of artificially cheap and

subsidized Chinese exports to the United States.

The U.S. relationship with China needs fundamental change:

addressing the exchange rate policies and labor standards issues in the

Chinese economy should be important national priorities. Wal-Mart’s

huge reliance on Chinese imports illustrates that many powerful

economic actors in the United States benefit from China’s unfair

trading system. Wal-Mart’s gain, however, is not the country’s gain, as

Wal-Mart’s imports have contributed to the ever-growing trade deficit

that imperils future economic growth.

—The author thanks Josh Bivens and Ross Eisenbrey for comments;

Elizabeth Glass for research assistance; and Molly McGrath, Kevin

Rudiger, and Aditya Pande for data analysis.

Endnotes

See Kimball and Scott (2014, 6 and “Appendix: Methodology,” 25–27) for further details.

This report distinguishes exports produced domestically and

re-exports—which are goods produced in other countries, imported into

the United States, and then re-exported to other countries, in this

case to China. Re-exports do not support domestic employment because

they are not produced domestically and they are excluded from the model

used here. See Table 1 for information about the levels of U.S.

re-exports to China in this period.

This model assumes that everything else is held constant; the trade and

job loss estimates shown here are based on counterfactual simulations.

The complete list of Journal of Commerce citations for 2004–2015, covering calendar year trade between 2003 and 2014, is available on request.

Wal-Mart (2007) reports that it “estimates about $18 billion worth of

products were purchased from China [in the fiscal year ending 2004] …

about $9 billion imported from direct sources and about $9 billion from

indirect.” These data are for Wal-Mart’s fiscal year ending on January

31, 2004, and were 11.9 percent of U.S. consumption imports from China

in 2003, when most of those goods were imported. The following

estimates all assume that Chinese imports are for Wal-Mart fiscal years

(FY), and are compared with total U.S. imports in the preceding

calendar years. Bianco and Zellner (2003) report that Wal-Mart imports

from China totaled $12 billion (11.8 percent of U.S.-China imports) in

FY 2002. Bianco (2006) reports that Wal-Mart imports from China were

$22 billion in FY2005 (11.2 percent of China imports). Bianco’s

estimates for FY 2004 replicate the estimate provided by Wal-Mart

(2007) for its FY2004 imports from China. Based on these estimates,

Table 1 assumes, conservatively, that Wal-Mart maintained a stable 11.2

percent share of U.S. goods imports from China between 2001 and 2013.

Between 2003 and 2013, overall

Wal-Mart net sales in the United States rose from $208.8 billion to

$336.6 billion (Wal-Mart Stores Inc. various years), rising from 7.7

percent of total U.S. personal consumption expenditures on goods in

2003 to 8.8 percent in 2013 (BEA 2015). Thus, Wal-Mart was a major and

growing channel for the distribution of both domestic and imported

goods in the United States in this period. Wal-Mart was also the single

largest U.S. importer of goods imported from all countries via ocean

container freight in 2014 (Journal of Commerce 2015), and was

responsible for 12.1 percent of the total containers imported by the

top 100 companies in that year. These data suggest that Wal-Mart’s

share of total China imports likely increased between 2003 and 2013.

Thus, the estimate of jobs displaced by Wal-Mart’s China trade in Table

1 likely represent a lower-bound estimate of actual jobs displaced.

Under U.S. rules, companies are allowed to petition Customs and Border

Protection (CBP) to avoid disclosure of company names on bills of

lading that accompany each shipment. Periodically, gaps appear in these

disclosure petitions, making importing companies known for short

periods of time. Comparable Wal-Mart data are available only for

November 2007 and 2012 from this database.

This calculation is based on the ratio of total Wal-Mart international

sales per square foot times an estimate of total Wal-Mart square

footage in China, in various Wal-Mart fiscal years (Wal-Mart Stores

Inc. 2002, 2006, 2014). Wal-Mart reports state that “over 95 percent of

the merchandise in our stores in China is sourced locally” (Wal-Mart

2015b). Export estimates in this paper assume that sales per store in

China were equal to the average per square foot for all Wal-Mart

international stores times estimated total Wal-Mart square footage in

China, and that all Wal-Mart imports into China came from the United

States (the average Wal-Mart store in China was 2.3 to 2.8 times larger

than the average Wal-Mart international store, based on data reported

by Wal-Mart Stores Inc. (various years)). This is clearly an upper

bound on total Wal-Mart exports to China because it assumes that all

Wal-Mart imports into China originated in the United States, which is

highly unlikely.

Wal-Mart had 6,107 international

stores at the end of FY2014 and total international sales of $136.5

billion in 2014, or about $22.3 million per store. Wal-Mart had 405

stores in China, with estimated total sales of $25.6 billion in FY2014,

and total imports of $1.0 billion (reported as U.S. exports in 2013 in

Table 1). Assuming that all these imports were shipped from the United

States, Wal-Mart was responsible for 0.9 percent of total U.S. exports

to China in 2013.

These estimates assume that jobs supported and displaced by Wal-Mart’s

China trade were directly proportional to total jobs supported and

displaced by total U.S. exports to and imports from China in 2001 and

2013, as estimated by Kimball and Scott (2014).

Direct jobs displaced refer to jobs displaced within a given industry,

such as motor vehicles and parts. Indirect jobs displaced are those

displaced in industries that supply inputs to that industry, such as

primary metal (e.g., steel), plastics and rubber products (e.g., tires

and hoses), transportation, and information. Re-spending employment

results from the spending of wages by employed workers. It is one form

of a macroeconomic multiplier.

Author’s calculations from the estimated $1,800 wages lost by a

median-wage non-college educated worker per year (Bivens 2013) times

the 68.1 percent of the workforce made up of workers with less than a

four-year college degree (U.S. Census Bureau 2015) times total number

of U.S. workers employed (on average) in 2014 from the Bureau of Labor

Statistics (BLS 2015) (yielding roughly 100 million non-college

educated workers).

The initial Wal-Mart commitment was to purchase $50 billion in “U.S.

products,” a figure that was subsequently increased to $250 billion

(Loeb 2013, Walmart 2015a).

References

Alliance for American Manufacturing. 2015. “ANOTHER Walmart Made in America Infographic Needed Some Work, So We Fixed It.” Manufacture This (blog of the Alliance for American Manufacturing). July 7.

Bianco, Anthony. 2006. The Bully of Bentonville: How the High Cost of Wal-Mart’s Everyday Low Prices Is Hurting America. New York: Currency/Doubleday.

Bianco, Anthony, and Wendy Zellner. 2003. “Is Wal-Mart Too Powerful?” Business Week. October 3.

Bivens, Josh. 2013. Using Standard Models to Benchmark the Costs of Globalization for American Workers Without a College Degree. Economic Policy Institute, Briefing Paper #354.

Bureau of Economic Analysis (BEA). 2015. “Table 1.1.5 Gross Domestic Product.” (Accessed October 27).

Bureau of Labor Statistics (BLS). 2014. “Employment, Hours, and Earnings from the Current Employment Statistics Survey (National): Manufacturing Employment.” [Excel file].

Bureau of Labor Statistics (BLS). 2015. “Labor Force Statistics from the Current Population Statistics: Employment Level.” [Excel file].

Bureau of Labor Statistics, Employment

Projections program (BLS–EP). 2014a. “Special Purpose Files—Employment

Requirements Matrix; Chain-Weighted (2005 dollars) Real Domestic

Employment Requirements Table for 2001” [Excel sheet, converted to

Stata data file]. http://www.bls.gov/emp/ep_data_emp_requirements.htm

Bureau of Labor Statistics, Employment

Projections program (BLS–EP). 2014b. “Special Purpose Files—Industry

Output and Employment – Data for Researchers, Industry Output.” [CSV

File, converted to Excel sheet and Stata data file]. http://www.bls.gov/emp/ep_data_industry_out_and_emp.htm

International Monetary Fund (IMF). 2015. International Financial Statistics. [CD-Rom, August 2015], Washington, D.C.: International Monetary Fund.

Journal of Commerce. 2015. “JOC Top 100 Importers in 2014: U.S. Foreign Trade Via Ocean Container Transport.” May 28.

Kimball, William, and Robert E. Scott. 2014. China

Trade, Outsourcing and Jobs: Growing U.S. Trade Deficit with China Cost

3.2 Million Jobs between 2001 and 2013, with Job Losses in Every State. Briefing Paper #385. Washington, D.C.: Economic Policy Institute.

Loeb, Walter. 2013. “How Walmart Plans to Bring Manufacturing Back to the United States.” Forbes. November 12.

Panjiva.com. 2015. United States Trade Data (subscription data service). (Excel sheets accessed October 23).

Scott, Robert E. 2007. The Wal-Mart effect: Its Chinese imports have Displaced Nearly 200,000 U.S. Jobs. Issue Brief #235. Economic Policy Institute.

Scott, Robert E. 2013. Trading

Away the Manufacturing Advantage: China Trade Drives Down U.S. Wages

and Benefits and Eliminated Good Jobs for U.S. Workers. Briefing Paper #367. Economic Policy Institute.

Scott, Robert E. 2015. “Increased U.S. Trade Deficit in 2014 Warns Against Signing Trade Deal without Currency Manipulation Protection.” Economic Indicator: Trade and Globalization. Economic Policy Institute, February 5.

Sovereign Wealth Fund Institute (SWFI). 2015. “Sovereign Wealth Fund Rankings: Largest Sovereign Wealth Funds by Assets under Management.” Accessed October 27.

U.S. Census Bureau. 2013. “American

Community Survey: Special Tabulation Over 45 industries, Covering 435

Congressional Districts and the District of Columbia (113th Congress

Census Boundaries), Plus State and US Totals Based on ACS 2011 1-year

file” [spreadsheets received March 6].

U.S. Census Bureau. 2015. “Current

Population Survey, Historical Time Series, Table A-2: Percent of People

25 Years and Over Who Have Completed High School or College, by Race,

Hispanic Origin and Sex: Selected Years 1940 to 2011” [Excel file].

U.S. International Trade Commission (USITC). 2014. “USITC Interactive Tariff and Trade DataWeb” [Excel files].

Wal-Mart Stores Inc. 2002. “Walmart 2002 Annual Report.”

Wal-Mart Stores Inc. 2006. “Walmart 2006 Annual Report.”

Wal-Mart Stores Inc. 2007. “Wal-mart Facts: Outsourcing.” [Html page downloaded April 3—available on request].

Wal-Mart Stores Inc. 2014. “Walmart 2014 Annual Report.”

Wal-Mart Stores Inc. 2015a. “Opportunity: US Manufacturing.”

Wal-Mart Stores Inc. 2015b. “Walmart China Factsheet.”

Wal-Mart Stores Inc. 2015c. “Walmart U.S. Manufacturing Announcements.”

|